Self Manage Super Funds

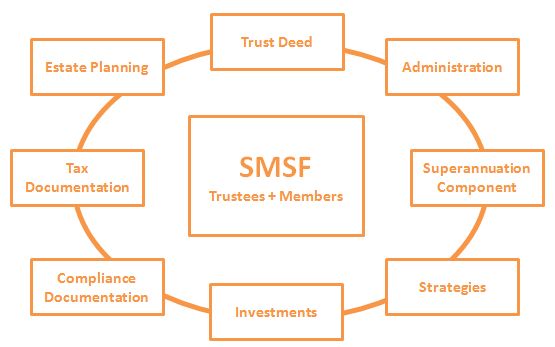

Self Manage Super Fund is kind of fund which is given to its members at the time of retirement. The biggest difference between SMSF and other funds is that the members of Self Manage Super Fund are the trustees of the fund. The main object to run these funds is to provide financial benefits to its members in retirement. All the investments are made in the name of Self Manage Super Fund and trustee hold the right to control it. Self managed superannuation fund also known as ‘do it yourself superfund’ They have their own account and all the amount is deposited in itself Manage Super Fund requires trustee and there are two trustee structure options are available.

- Corporate Trustee – In this type of option a company acts as a trustee and other members as a director. This is very simple and easy structure of maintaining administration and record keeping. It also gives flexibility in membership and easy working style. A company fees is applicable in it.

- Individual Trustee – In this kind of option each member is selected as a trustee and minimum two trustees required.

Responsibilities of Self Manage Super Fund trustee

- The trustees are responsible for making investment decision and implementation of their funds with strategy.

- Self Manage Super Fund has strict rules and regulations which trustees have to follow strictly. They have to maintain records, file tax returns, organize audit. They can hire audit experts for this work.

- They are full responsible for their decisions.

Self Manage Super Funds Types

- My Super – This is a new kind of account which has replaced all super fund default accounts. If you do not go for super fund then employers job to employer contribution into My Super Account.

- ATO Regulated SMSF – This fund is managed by Australian Tax Office and there are very few members in this type of account. Anyone cannot become trustee who is not a member. There is no remuneration given to the trustee for providing services.

- Approved Deposit Fund – Approved Deposit Funds can be managed by single or multi-member. They can hold, invest or receive funds until the accounts are removed.

- Non Regulated Super Fund – This type of fund does not come under the rules of Australian Tax Office. Non Regulated Self Manage Super Funds cannot be complying fund unless it is exempted from public sector schemes.The SMSF is a very comfortable fund in terms of transferability. In emergency circumstance you can even withdraw money.